Gen Z is making BNPL a lucrative option for Fintech & beyond

How does Gen-Z feel about credit cards? The answer to that question may be a bit complicated, according to some recent reports on the spending habits of the much discussed post-millennial generation.

Members of Gen-Z own less credit cards than the average consumer – 1.5, compared to 4 – and there are some indicators that they are less likely than previous generations to use credit as a primary payment method.

Now, this is not to say that young people have abandoned credit entirely; credit card usage remains widespread across all consumers polled, and over half of zoomers have at least one. That said, Gen-Z may be more willing than previous generations to explore alternatives to credit that are “low-commitment, straightforward… budget-focused, customer-centric and empower rather than entrap,” according to a 2020 report from Afterpay.

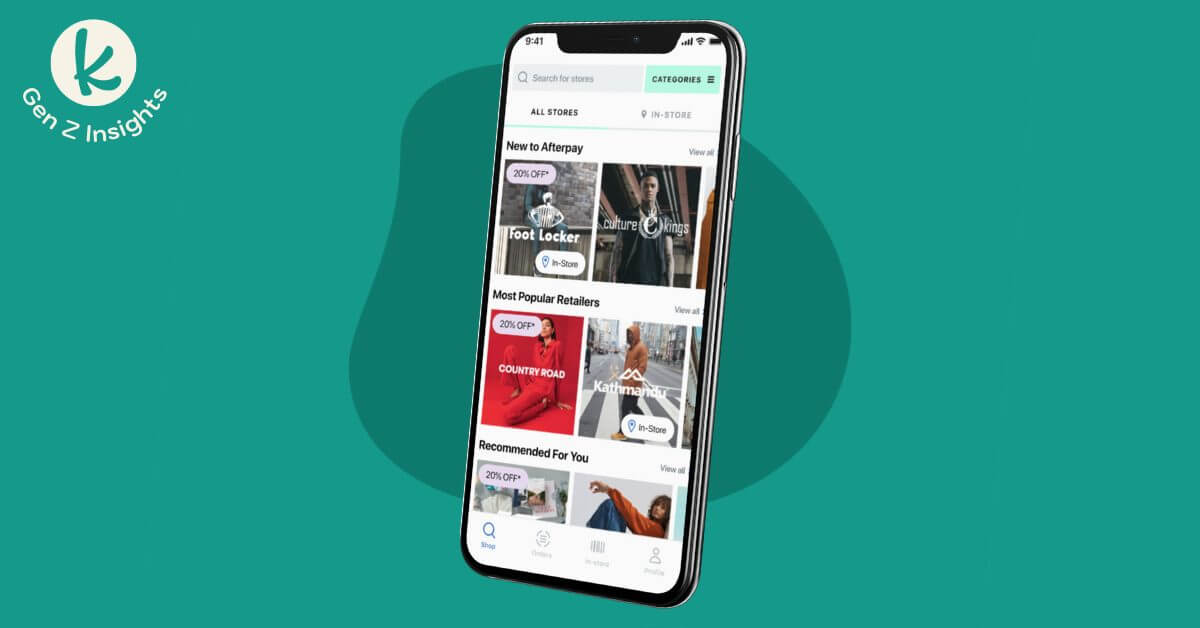

One of the most intriguing and fast-growing of these alternatives is Buy Now Pay Later (BNPL), a kind of financial service marketed by companies like Afterpay, Klarna, and Sezzle. The premise of these BNPL plans is deceptively simple: consumers receive a product for no money upfront, and pay later, all at once or in installments. Payment plans are generally more flexible than a fixed monthly credit card bill, and in many cases no interest is charged.

The rise in popularity of BNPL over recent years has been meteoric – especially among budget conscious zoomers. Data sourced from Accenture shows that between 2019 and 2020, Gen-Z spending on BNPL increased by over 200%. Another report, from YPulse, found that 22% of consumers aged 19-39 have tried a BNPL product – and an additional 29% have plans to in the future.

Clearly, there is great opportunity for growth in the BNPL space, whether that be for fintech startups like Afterpay or more traditional financial institutions looking to diversify their offerings. But what is the explanation for this sudden surge in popularity, especially considering that similar kinds of “layaway” plans have been available to consumers for decades?

Part of the answer to this question has to do with larger, macroeconomic trends – trends which are broadly coinciding with the widespread entry of Gen-Z into the workforce. An analysis of these trends can help the financial industry understand how to best leverage BNPL as part of their wider strategy to court Gen-Z consumers.

It is a well-established truism by now that, while the defining generational moment for millennials was 9/11, for Gen-Z that honor belongs to the 2008 financial crash. Growing up in the shadow of this crisis has defined the financial habits of many zoomers.

It has led them to become more frugal, spending less and saving more. It has limited their employment options, leaving many to rely on insecure gig and contract positions. It has even led to an increased willingness to support socialist policies, an unthinkable proposition for older, more financially stable generations. Of course, these attributes can not all be credited solely to the 2008 crisis, but are rather the culmination of a myriad of factors. And with the financial effects of COVID-19 also hitting Gen-Z harder than other generations, as well as skyrocketing levels of student loan debt, these trends will only be amplified in the years to come.

In many ways, Buy Now Pay Later can be seen as the industry’s response to the distinctive behaviors that Gen-Z brings to the marketplace. For debt-averse zoomers, daunted by the possibility of a mounting credit card bill, BNPL can seem like a more affordable, flexible option. In addition, BNPL is perfectly fitted for Gen-Z’s desire to form more personal connections with brands. Rather than mediating purchases through banks and other traditional financial institutions, brands can offer flexible payment plans directly to consumers, helping to nurture the brand/consumer relationships that zoomers cherish. Microsoft is one company that has experimented with BNPL recently, allowing consumers to buy the new Xbox in a series of monthly installments. Mastercard, too, partnered with payment processor TSYS in 2020 to introduce a range of BNPL options to current card-users.

Microsoft, Mastercard, and other companies experimenting with new payment methods, are effectively responding to current trends in order to better serve Gen-Z consumers. They are making a bet on a relatively new idea, and they ought to be admired for that.

Even though credit cards are not going anywhere, the popularity of BNPL means that incumbent financial brands would be foolish to ignore it – unless they want to be outpaced by startups and shrewd competitors. Gen-Z, although still in its early stages of bringing capital to the marketplace, is poised to drastically increase their buying power in the coming years as our country begins to undergo the greatest wealth transfer in its history.

Buy Now Pay Later is just one way that financial brands can adapt to this new, coveted demographic, but it could be a highly lucrative one: one optimistic report estimates that BNPL transactions could reach as much as $680 billion by 2025. Regardless of whether they invest in BNPL, every company should be considering how their current practices can be best adapted to reach a Gen-Z audience in the years to come.

Subscribe for industry insights delivered weekly.

Get all the Knit News you need with access to our free newsletter to stay a step ahead on the latest trends driving the industries of tomorrow.