Fintech is having its Gen Z moment

Here’s what you need to know

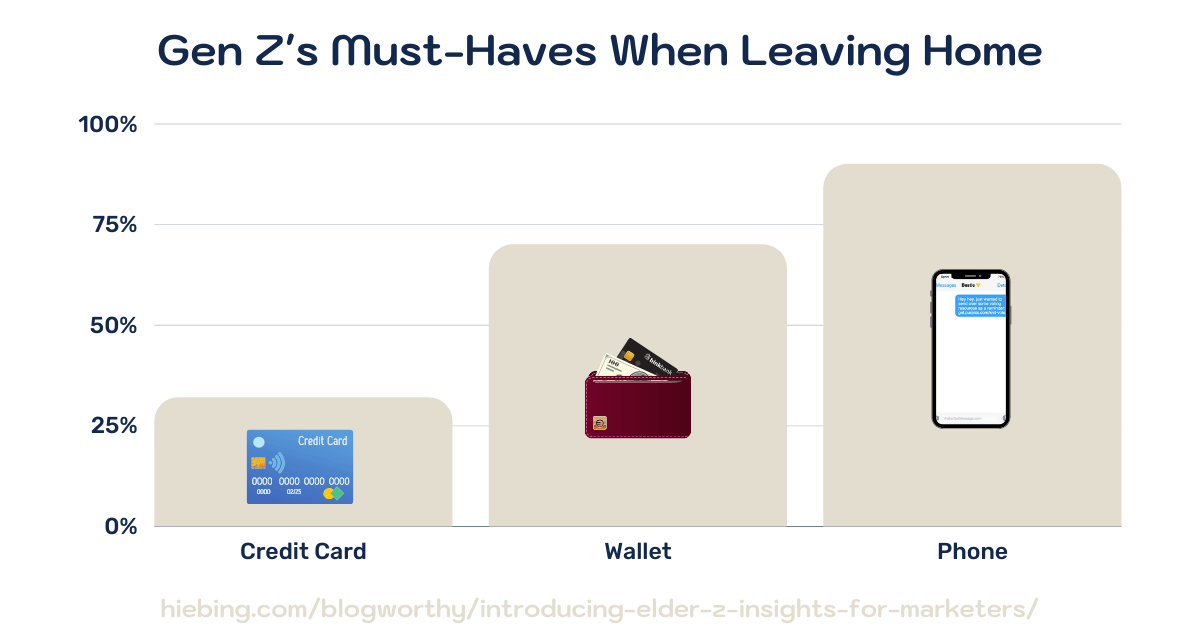

Gen-Z, which comprises those born between 1997 and 2012, is predicted to make up 17% of spending in the US economy by 2030. As the first generation to grow up not just with the internet, but with ready access to smartphones, it’s a no-brainer that the future of finance for zoomers will revolve around digital and mobile offerings. (A 2020 poll from Hiebing showed that 90% of Gen-Z would not leave the house without their phone, while only 70% said the same about their wallets!)

Partly in response to this new demographic, the last few years have seen an explosion of Fintech startups, apps, and web-based financial services that aim to meet young people on their own digital turf.

What follows are a few insights on the specific areas where Fintech may see the most success at reaching Gen-Z. Although between 50 and 80% of zoomers may already use mobile banking, the key to winning them over is about far more than just offering traditional banking services in app form. From budgeting to investing, there are numerous ways for innovative Fintech companies to cut through the competition and earn the trust – and the business – of the zoomers.

For them, it’s personal.

For zoomers, the internet is more than just a tool. It has been with them for their entire lives, equal parts encyclopedia, swiss army knife, and trusted confidante. This has led many of them to a favorable view of the internet, with 66% believing it can bring people closer together, and 56% saying they are friends with someone they only know online. This can be good news for banks and other Fintech companies, who can rely on reaching Gen-Z customers through online channels. But it also means that their expectations are a little different.

The key word is personalization. As digital natives, zoomers have no problem scouring the web for a product suited precisely to their needs. The more customizable an offering is, the more likely they are to choose it. In addition, many of them expect brands to communicate with them on a personal level, and even to share their values. Among older zoomers, 85% of respondents in a recent poll said they wanted brands to “make the world a better place.” Clearly, Gen-Z expects a “personal” touch – in multiple senses of the word – from any company they do business with.

In some ways, the financial sector is falling behind in this regard. Nearly half of Gen-Z considers banking interactions either “not personalized at all” or only “slightly personalized” compared to platforms like Amazon or Netflix. But there are plenty of ways a smart Fintech company can stand out. Interviews conducted by Knit indicate that zoomers rely extensively on word of mouth and peer recommendations to find financial services and apps. This opens an opportunity for companies to leverage brand ambassadors and even influencer marketing, establishing a personal relationship with Gen-Z consumers.

In addition, the rise of “Altruistic Investing” – firms or banks such as Aspiration that prioritize social or environmental justice in their investments – may provide a blueprint for how to capture the trust of civically minded zoomers. The bottom line is that in order to win over Gen-Z, brands need to get personal: both in the products they offer, and in the way they communicate.

The D-word.

One recent financial trend of note is the rise of Buy Now Pay Later (BNPL) apps. Although they did not invent the concept of BNPL – a purchasing option in which consumers pay for products in installments over a predetermined time frame, often with no interest – companies like Klarna and Pay L8r have become increasingly popular in recent years, especially among a younger audience. Gen-Z spending on these apps has increased by over 200% since 2020, and in the UK BNPL is the fastest growing online payment method.

What is the reason behind Gen-Z’s attraction to BNPL, and what lessons can Fintech companies learn from their popularity? While many cite the convenience of BNPL as a major factor, it is also interesting to note that many see the services as a supplement or even an alternative to credit cards. For those with a less stable income, or those looking to avoid falling into debt, the no-strings-attached nature of BNPL is a major benefit. This leads us to our next keyword, one that defines zoomers as much as it haunts them: debt.

While millennials cite 9/11 as the most formative event of their younger years, for zoomers that honor is more likely to belong to the financial crash of 2008. Growing up in a post-recession world, Gen-Z has never had the privilege of taking a prosperous economy for granted. Financial well-being is viewed as being more precarious, and trust in major financial institutions shakier. At the same time, this sense of disillusionment may have led zoomers to form healthier, smarter money habits. A 2020 study from TransUnion showed that half of credit-active zoomers have a credit score in the prime range, compared to 39% of millennials at the same age. At the same time, less zoomers have taken out student loans compared to millennials – 37% compared to 44%. In fact, college registration is declining overall among Gen-Z, many of whom view the benefits of a degree as not worth the cost of debt.

Now, this is not to say that Gen-Z is an inherently frugal generation. Zoomers actually owe more credit card debt than millennials did at the same age, and could be on the path to owing more in the long run. Instead, the lesson to take from trends like BNPL and dwindling interest in student loans is that debt and financial stability sits heavy on the mind of Gen-Z, whether they owe anything or not. Participants in Knit interviews repeatedly expressed a desire for financial guidance from banks, seeking advice on topics such as budgeting, investing, and even cryptocurrency.

Eyes on the prize.

It is hard to predict exactly what the future will hold for the companies currently competing in the Fintech marketplace. Undoubtedly, many institutions will choose not to make any drastic changes to their business practices in the face of generational tide shifts. After all, Gen-Z climbing its way into becoming a substantialstill makes up a relatively miniscule slice of the economy. Companies accustomed to an older clientele will hardly suffer in the short term from remaining stuck in their ways.

But like it or not, Gen-Z is the future. Along with millennials – with whom they share many similar traits and behaviors – the zoomers will make up nearly 50% of spending by 2030. For banks and Fintechs vying for Gen-Z dominance, too, the stakes are high. 43% of Gen-Z uses a single institution for all of their financial needs, and nearly two thirds would do the same if they found one company that met all of their needs. Companies that pay close attention to the needs and pain points of Gen-Z, and that are willing to adapt their current business practices to new audiences, may secure a valuable, loyal customer base across every vertical.

Subscribe for industry insights delivered weekly.

Get all the Knit News you need with access to our free newsletter to stay a step ahead on the latest trends driving the industries of tomorrow.